Did You Really Think All Billionaires Were the Same?

Recently, I became a bit obsessed with the one percent of the one percent – Billionaires. I was intrigued when I stumbled on articles telling us who and what billionaires really are. The articles said stuff like: Most entrepreneurs do not have a degree and the average billionaire was in their 30s before starting their business. I felt like this was a bit of a generalization and I’ll explain. Let’s take a look at Bill Gates and Hajime Satomi, the CEO of Sega. Both are billionaires but are they really the same? In the past decade, Bill Gates has been a billionaire every single year while Hajime has dropped off the Forbes’ list three times. Is it fair to put these two individuals in the same box, post nice articles and give nice stats when no one wants to be a Hajime? I think not – especially when, in this decade alone, inconsistent billionaires like Hajime make up over 50% of the total billionaire population. Addressing the differences between billionaires is what this post is about. We are going to highlight interesting facts about the consistent billionaires and ultimately, find out what separates the consistent billionaires from the rest.

Just what do I mean by consistent billionaires? Well, that’s what we’re here for. 🙂

For the Nerds Like Me, Here’s How I did It

- Data Sources: Most of the data was scraped from 3000 Forbes profiles. Two extra variables were collected from a research paper: The Billionaire Characteristics Database. Billionaires covered are those who are or have been billionaires between 2007 and June, 2017.

- Data Gathering: Using names of billionaires I created their Forbes profile URLs and collected the data I needed using RSelenium and rvest. I’ll be frank. It was not sexy at all. I did a lot of Excel VLOOKUPS, manual inspections and string manipulation to get a workable data set.

- Data Cleaning: I created columns from strings using stringr.

The code can be found here.

Just How Many Types of Billionaires Are There?

Here’s what I came up with:

- The Consistent: These, as the name implies, are individuals who have consistently been billionaires year in and year out. It also includes billionaires that have been away from the list for at most a year (e.g. Mark Zuckerberg in 2008). They should have been billionaires before 2015.

- The Ghosts: These are billionaires who left the list and have not returned in the past four years. They also should have made their debut before 2015.

- The Hustlers: This category includes every other billionaire who made their debut before 2015. I.e.

- Those that left more than once and made a comeback each time.

- Those who, although made it back to the list, spent more than a year away.

- Those who are yet to come back but have not spent up to 4 years off the list.

- The Newbies: These are billionaires that made their debut between 2015 and 2017. They are in a group of their own because I believe it would be unfair to put them in anywhere else as there isn’t enough data to classify them in any other category. Nonetheless, I think it would be interesting to see what they’re up to.

So, let’s get to it!

Did You Know That?

The Consistent billionaires are well-educated.

Close to 55% of the Consistent billionaires have at least one degree.

In fact, the Consistent billionaires have the most people with a Bachelor’s, PhD, Masters and pretty much every other degree.

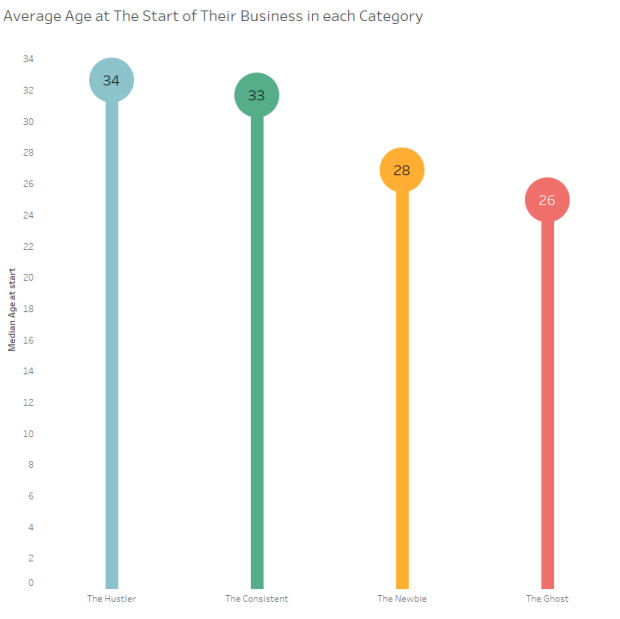

The average Consistent billionaire started their businesses at an age seven years older than the average Ghost.

This applies to billionaires who are self-made and started a business. The average Consistent billionaire starts their business in their 30s on average which agrees with the article on successful starting their 30s.

Does the Ghost billionaire starting his/her business at least two years earlier than everyone else say something about younger entrepreneurs being less likely to sustain their wealth? Probably. However, if you look at the Newbies, they mostly started out young too. The question is: Will the average Newbie end up a Ghost or has the playing field changed in the past few years? We can answer that in a few years. 🙂

The top three sectors that produce the highest percentage of Consistent billionaires are Telecoms, Fashion and Diversified portfolios.

Looks extremely mainstream, right? But Fashion? Really?

Note: Fashion and Retail here does not mean Retail. It means businesses retailing Fashion merchandises like Zara, H & M etc.

African billionaires are the most likely to be Consistent billionaires

Close to 70% of African billionaires are Consistent – more than any other region in the world. The region that comes closest is North America with 53%.

In the Newbie Era, however, Asia seems to be dominating every other region and this number is mostly driven by China. In fact, over 50% of Chinese billionaires joined the list during this period.

On the other hand, Middle Eastern billionaires are the most likely to be Ghosts. I know what you’re thinking. Oil prices, right? Probably. However, most of Middle Eastern billionaires have diversified portfolios.

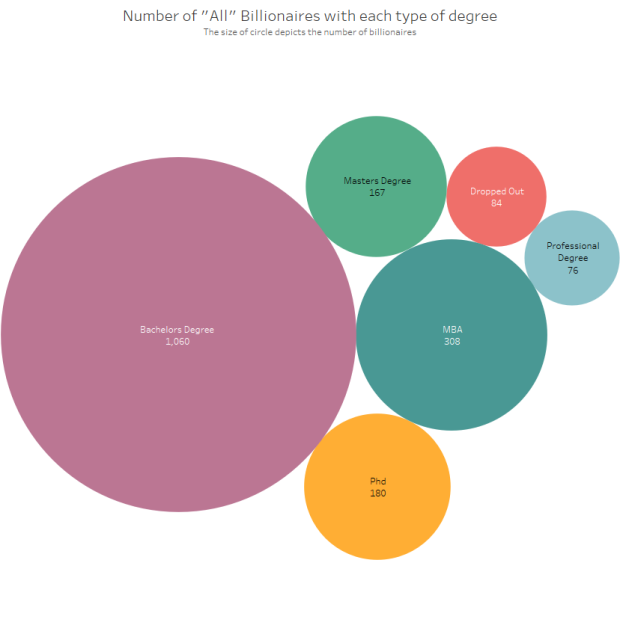

There are more billionaires with a PhD than there are drop outs.

This is my favorite.

This applies to all other degrees like MBA, MSc etc. Only professional degrees like Law or Medicine have fewer billionaires than drop outs. However, in the Newbie and Hustler categories, there are even more people with a professional degree than there are drop outs.

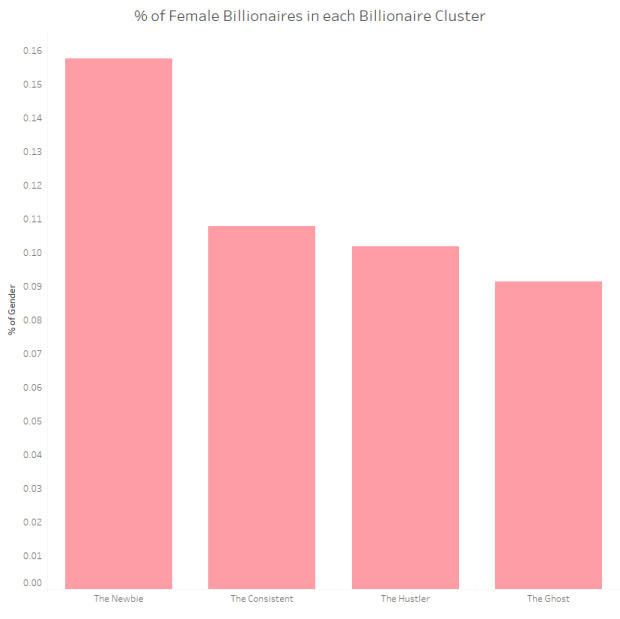

11% of Consistent billionaires are female.

The only category with a more encouraging female-to-male ratio is the Newbie category with about 16 percent. However, given that the global male to female ratio is 50:50, the Newbie category is still 34 percent short. The good news is things are getting better. A woman is close to two times more likely to be a billionaire since 2015 than before that.

64% of Consistent billionaires are self-made.

The only category with a lower percentage is The Ghost. The good news (or bad news – depending on where you hope your wealth would come from) is that the Newbie billionaire has a higher percentage than that. This means that in recent times, more “new” wealth is being generated. Also, it seems being self-made isn’t a peculiar thing seeing as each category has over 60% of their billionaires being self-made.

Cool, Now What?

The billionaires we all know and love are well-educated and frankly, generally boring.

“How much does this matter if you want to become a Consistent billionaire?”

To answer that, we will do a bit of Machine Learning (bear with me here, it might get a little technical). Using the h2o.ai machine learning package (I love!), we would train models to predict what category a billionaire will fall into. We would do this for all the categories except The Newbie because, unlike the others, all that distinguishes this group is when they joined the list and not their performance while on it. We would also use truly independent variables to train our models. For example, a variable that was used to create the categories like the number of times they left the list won’t be used. It would be like knowing the answer and working backward if we use variables like that, right? We would then check which variables were the best in predicting a billionaire’s category to answer our question. The code is also available in the same script shared above.

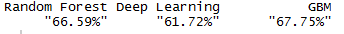

I would first use the purrr and h2o package to find the best algorithm between Gradient Boosting Machines, Random Forest, and Deep Learning.

Looks like the accuracy of the GBM algorithm on the test set beats the other machine learning algorithms.

Let’s check what variables GBM considers most important in predicting a billionaire’s category.

We see three variables above the 50% relative importance: Country, Sector and the founding year of the company that got them their wealth.

What does this tell us about Consistent billionaires? For one, it says that while the Consistent may be well educated, that’s certainly not what got them there. It’s not shocking that Country and Sector are important variables but “founding_year” is intriguing. It could mean that it may be getting easier or harder to build a sustainable business.

Again, pretty straightforward and boring. Be in an enabling environment at the right time for the sector you play in and BOOM! You make sustainable wealth. At this point, I feel I am obligated to say that 84% of technology billionaires are in North America and Asia. There are currently none from Africa (See sentence above about an enabling environment for your sector) but then again, you can be the pioneer so take my advice with a bag of salt. Good luck!

Things to Keep in Mind

- The data was gotten from Forbes. This means that I am inherently constrained by their methods, estimates, and errors. For example, the data says there is only one billionaire from Politics. I’d rather diezani than believe that’s true.

- At the end of the day, I ended up with over 30 variables and I cannot talk about all of them in one post, so here are some visualizations for you to play around and find out for yourself how to become a Consistent billionaire. 😉

- Want to find out who the Consistent billionaires are? Find out using the full data set here.

- In my next post, I am going to address what sectors, countries and founding years are the best in becoming a consistent billionaire and;

- I have a LITTLE surprise. 🙂

Reblogged this on Muyiwa Saka and commented:

This is a truly original research and something you’d definitely want to read.

LikeLike

This was an awesome read, great work and research too , learnt new things. Waiting for the next post

LikeLike

Reblogged this on softwaremechanic.

LikeLike

Great read man! Maybe an interesting follow up question would be when does the average consistent billionaire make their first million?

LikeLike

Awesome Stuff !

LikeLike

That’s amazing!

What was the little surprise that you mentioned at the end of the article?

LikeLike

Thank you! The surprise is in my next blog post. 🙂

LikeLike

Cool post and great use of visualisations.

LikeLike

Interesting research and nice visualizations. If only we can rely on Forbes data then observations about degrees and ages are great. I’d just like to add one thing, you wrote: “However, given that the global male to female ratio is 50:50, the Newbie category is still 34 percent short. The good news is things are getting better.” – for me, there is no “better” here. It’s just the fact that the percentage is what it is, there is nothing better in 50:50 ratio of billionaires than in 30:70 or 20:80 ratio.

LikeLike

Totally agree. It is merely a personal preference and nowhere did I posit that having more or less female billionaires is good or bad for the world. Thank you!

LikeLike

I’m looking to be part of that “female newbie” cluster… launching an new social network in November: http://www.vaudle.com

@VaudleApp

LikeLike

This is awesome. Data never lies :😊

LikeLike

Coming from a nerd, you should NEVER use VLOOKUPs in Excel: they are the absolute devil. Use INDEX and MATCH instead! 😉

On topic: What an amazing article. I really enjoyed it!

LikeLike

You are very correct! Thank you

LikeLike

The data never lies, but we must be careful in the conclusions we draw or they can be misleading. Note that “Professional Degree” might be advanced or the equivalence of a Bachelors depending on subject of study. If we assume advanced (or even if we ignore it altogether), the statement that there are more P.h.Ds than drop-outs holds true according to the data. However, conclusions are worded to claim that billionaires usually have advanced degrees. This, the numbers actually disagree with. Most do not consider a Bachelor’s degree to be “Advanced” and yet this is the single largest group showing in the bubble graph. Bachelor’s or less holds a clear majority as does Bachelor’s all by itself, implying that Advanced degrees and drop-outs form the “edge case extremes” rather than the data favoring advanced degrees. Overall though, the findings are both interesting, well organized, and this article is very well put together. We almost watch out for bias in our own assumptions driving how we word our conclusions and analysis. Your presentation does bring to light something interesting though. Years ago, in the days when Sam Walton came to fame, more billionaires than not seemed to be without degrees at all or in the drop-out category. Now it seems more common for them to at least have a bachelor’s and the drop-out category has become an edge case. Is this because of technology and the “Age of Information”? I have no data on this but would think it might be the case.

LikeLiked by 1 person

I appreciate your healthy nack for curiosity!

LikeLike

Rosebud, thank you for taking the time to write and create this post and research. For some of us not working directly in data science, it is great to have a window into your world of expertise. Please keep up the great work!

LikeLike

Thank you, Tim!

LikeLike

Loved it. My head is bursting with ideas right now, looking forward to the next article. Thank you.

LikeLike

Beautiful read. Nice “diezani” joke

LikeLike

Reblogged this on Clearhaven and commented:

Some interesting analysis

LikeLike

This is great stuff Rose.

Please reach out to me via: francis@cchubnigeria.com if you’ve got an idea for a business/product you’ll like to use your data science skills for.

Cheers.

LikeLike

Thank you

LikeLike

the best thing I have read on the net today!

LikeLike